DRC 01: Demand and Recovery Certificate- DRC 01 is a form under notification No. 49/2019. The GST officers usually utilize the form to provide a show-cause notice to a taxpayer. If a taxpayer is chargeable under the tax or interest penalty, GST for DRC 01 is used by the officer to get the details of tax, interest, and penalty.

There are some essential details on the form, including:

- GST number to whom SCN is given.

- Unique reference number

- Section reference number under GST law.

- Address and additional data.

- Details about tax duration and the financial year for which the notice is issued.

- An outlined summary of all the events that resulted in the issue of show cause notice.

The reason why DRC 01A in GST is issued

The taxpayer who is chargeable in the tax and interest penalty in GST is sent a notice or statement by the department. As per the previous GST rules, for serving the notice or statement, the proper GST officer issued a summary in form DRC 01 or DRC 02 as per the case, specifying all the tax payable requirements. However, there is a new sub-rule inserted in this, which states that tax, interest, and penalty are to be communicated to the taxpayer first before the notice gets serviced. So, this DRC 01 is an intimation more than a cause notice.

What are the changes in the rule and its related effects?

- The show cause notice was issued through DRC 01 before the introduction of rule 142 (1A). According to the changes, the intimation is issued first under DRC 01 before the initial show cause notice. With this change, taxpayers get additional time to pay the differential tax amount.

- There are many instances when taxpayers have directly received show cause notice. In such cases, a taxpayer can ask the proper officer to send intimation first by DRC 01.

- After receiving the intimation from the proper officer, the taxpayer has to pay under section 73(5) or 74(5). So, there will not be any penalty imposed by the officer.

- However, if the taxpayer does not agree with the liability, they can reply with part b of DRC 01A.

How can a taxpayer respond to DRC 01?

When receiving the DRC 01 from a proper GST officer, the taxpayer can use other parts of the form to communicate. Part B of DRC 01 is used by the taxpayer to communicate whether the taxes are paid or the taxpayer does not accept the liability. In both cases, the taxpayer has to communicate with the proper officer. Here is the way taxpayers can respond to DRC 01:

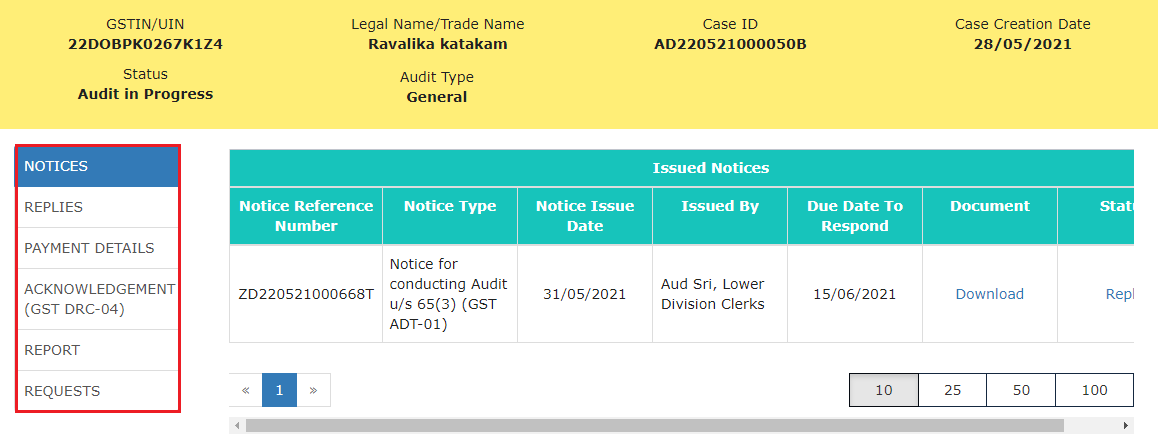

- Visit the official GST portal to log into your account using your credentials.

- Once you can access the account, check the services tab on the website. Move to additional notices/orders, and you will have to list notices or orders.

- Check the notice description to ensure you are clicking on the right one; click “View” on the right column of the notice. You will get access to download, download the notice to give a thorough read about the details. These details include the type of notice, reference number, the due date for reply, issue date, personal hearing details, and section number.

- Draft a reply based on the required issue and the taxpayer’s communication to the officer.

- Navigate to the reply section in the portal, click on “add reply”, and select reply to SCN.

- Attach the required documents. You will have to appear in a physical meeting to authenticate these documents. In addition, the decision will appear in the case details.

How to obtain the DRC 01 form?

To have access to the format of the DRC 01 form, here are some of the steps that you can follow:

- Visit the official GST portal to check the format of the DRC 01 form.

- Log in to your GST account with your login credentials.

- Click on the services section tab where you can find user services. Select my application option, which is available in user services.

- Search for forms related to DRC 01 A or relevant application forms. You will most likely find these forms under the “Appeal” or “legal services” section.

- Click to download the form; you will get a PDF or Excel version along with instructions or a user manual.

- Fill out the form and submit it online.

The DRC 01 is an important form to respond to avoid penalties and pay any differential amount on time.

What is DRC 01B in response to DRC 01?

DRC 01B is a form used to inform the proper officer about the intimation received by the taxpayer. The DRC 01B is applied to various taxpayers, including regular taxpayers, casual taxpayers, composition taxpayers, SEZ units and developers. In addition, the DRC 01B can be generated monthly and quarterly as per the frequency of filing GST.

Conclusion

DRC 01 form with new sub-rule allows taxpayers to get some time for the amount payable. The taxpayer also has the flexibility to accept or pay the calculated tax mentioned in the intimation. However, they have to provide documents and draft a response for either of the reasons. So, it allows taxpayers to resolve the tax dispute without facing a penalty.

Frequently Asked Questions

- Who is responsible for DRC 01?

The proper officer is responsible for DRC 01 in GST.

- What is the difference between DRC 01 and DRC 01 A?

DRC 01 is an intimation of tax payable to taxpayers, giving them time to pay any differential amount. DRC 01A is a summary outline of the series of events that led to the show of cause notice.

- What is the time limit for replying to DRC 01?

The taxpayers have to reply to DRC01 within seven days of the intimation issued by the officer about the response to acceptance or non-acceptance of the intimation. In case of late or no response, a taxpayer can face GSTR-1 filing blockage and demand notice under the CGST Act.